Our real estate development strategy is focused on directly and efficiently connecting investors to the returns generated by residential projects in the São Paulo metropolitan region — the most mature, resilient, and liquid market in the country. With proven expertise across every stage of the real estate value chain, strict governance, and a disciplined risk management approach, we structure opportunities that combine asset security with high appreciation potential, delivering consistent and transparent performance.

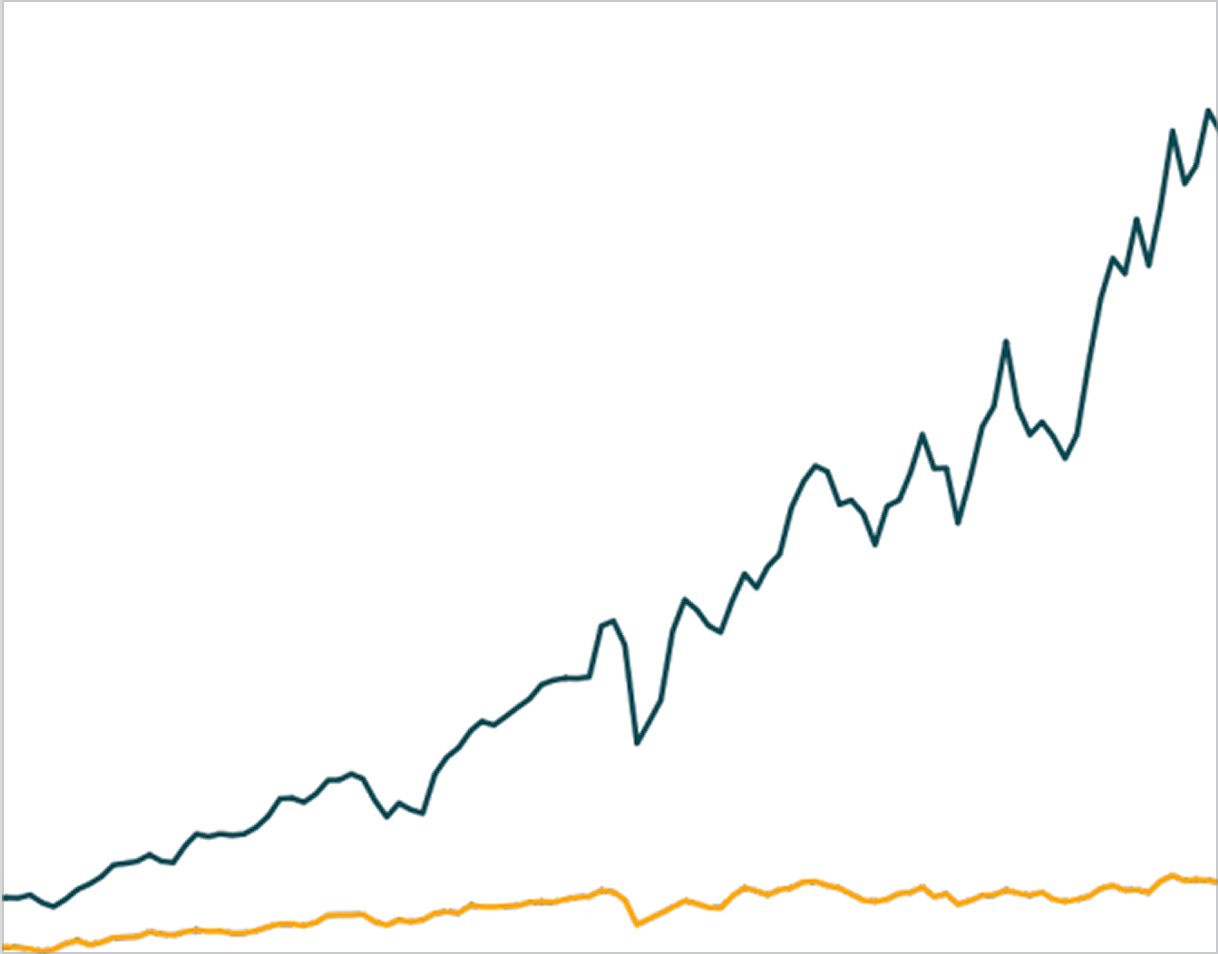

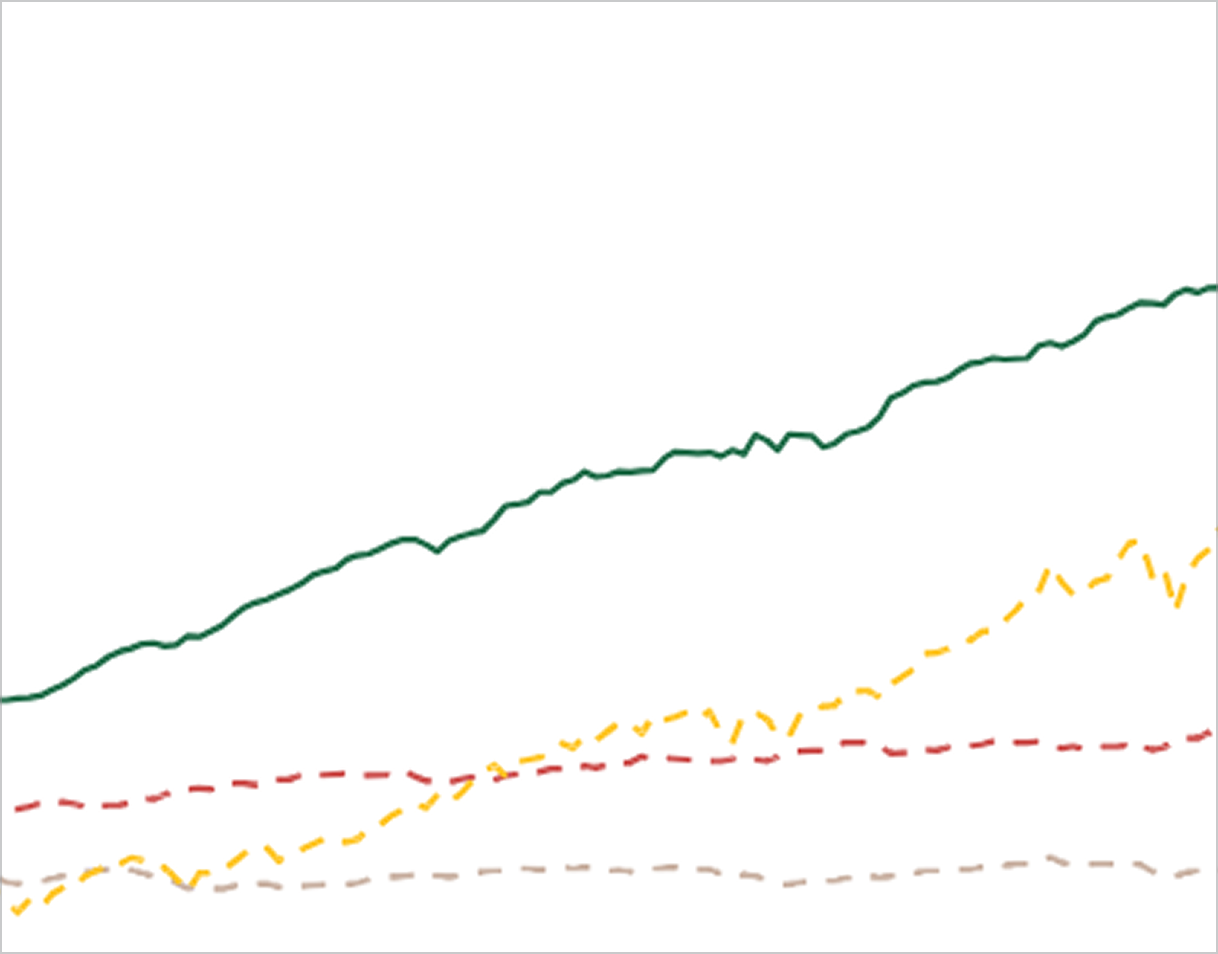

São Paulo accounts for 50% of new property sales in Brazil, establishing itself as the country's leading real estate market. Its prices have demonstrated resilience throughout market cycles, reinforcing its attractiveness to investors.

With a robust labor market, São Paulo attracts investments and skilled migration, driving real estate demand. The region's per capita income exceeds the national average, strengthening purchasing power and market liquidity.

São Paulo has a well-established supply chain, ensuring efficiency and predictability in operations. Long-term strategic partnerships guarantee quality and stability in project execution.

The price per square meter in São Paulo remains resilient to economic cycles, acting as an asset protected against inflation and ensuring sustainable appreciation.

“We only build where the view reaches” — a principle that has guided our operations with solidity, transparency, and performance for four decades.

We receive over 50 plots of land monthly for development, of which approximately 15 undergo detailed studies.

Once an opportunity is identified, we analyze market assumptions and costs to validate financial feasibility, adopting conservative parameters and mitigating unforeseen risks.

The acquisition is unanimously approved by the investment committee, followed by legal, technical, and urban due diligence processes.

Legal, preliminary, and executive projects are developed and approved by São Paulo City Hall (PMSP).

We align the advertising campaign with the target audience, organize sales teams, and set up booths for client and broker engagement.

Construction is outsourced, with in-house management to mitigate delays and control unwanted costs.

At delivery, we transfer clients to the banks, completing the settlement of the SFH financing.

We receive over 50 plots of land monthly for development, of which approximately 15 undergo detailed studies.

Once an opportunity is identified, we analyze market assumptions and costs to validate financial feasibility, adopting conservative parameters and mitigating unforeseen risks.

The acquisition is unanimously approved by the investment committee, followed by legal, technical, and urban due diligence processes.

Legal, preliminary, and executive projects are developed and approved by São Paulo City Hall (PMSP).

We align the advertising campaign with the target audience, organize sales teams, and set up booths for client and broker engagement.

Construction is outsourced, with in-house management to mitigate delays and control unwanted costs.

At delivery, we transfer clients to the banks, completing the settlement of the SFH financing.

Read our Disclaimer and Privacy Policy.